Introduction

The Nasdaq Composite is a key indicator of the performance of technology and internet-related stocks in the U.S. stock market. Investors and traders closely scrutinize its movements to gain insights into the overall market sentiment. In this article, we will conduct a detailed analysis of the Nasdaq Composite’s 1-hour time frame for 30th Jan 2024, focusing on various oscillators, moving averages, and pivot points to unravel potential trends and opportunities.

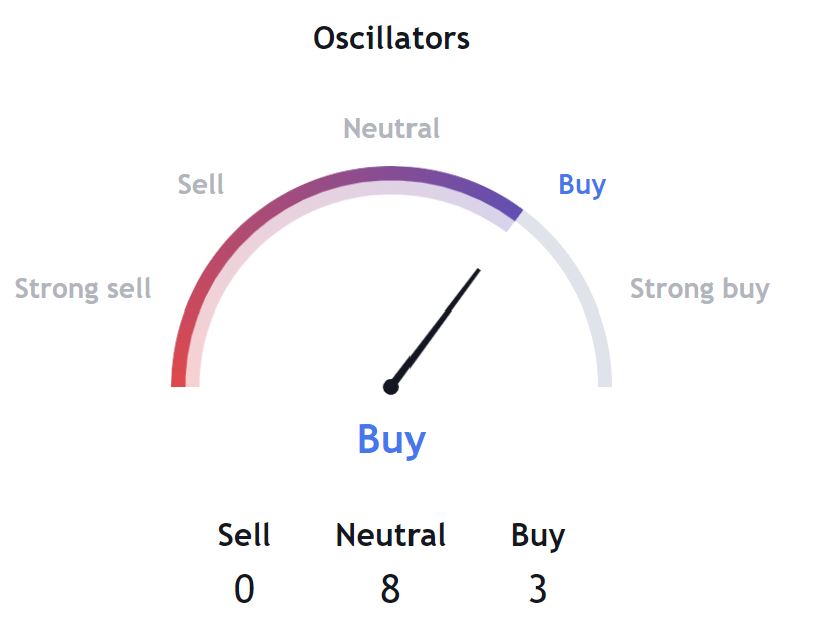

Oscillators Analysis for Nasdaq Composite

Oscillators are crucial indicators that help assess the momentum and potential direction of a market. The 1-hour time frame analysis of Nasdaq Composite’s oscillators provides a snapshot of the current market conditions.

- Relative Strength Index (RSI 14): The RSI stands at 70.11, indicating a neutral stance. A value above 70 suggests overbought conditions, but neutrality suggests a balanced market sentiment.

- Stochastic %K (14, 3, 3): With a value of 96.77, the Stochastic %K indicates a neutral stance. However, a value close to 100 may suggest potential overbought conditions.

- Commodity Channel Index (CCI 20): The CCI stands at 204.18, signaling a neutral position. An extreme CCI value may indicate potential reversals, but neutrality suggests a balanced market sentiment.

- Average Directional Index (ADX 14): The ADX at 25.49 suggests a neutral stance, indicating the absence of a strong trend.

- Awesome Oscillator: With a value of 56.80, the Awesome Oscillator points to a neutral position, reflecting the balance between bullish and bearish forces.

- Momentum (10): Momentum stands at 166.56, indicating a buy signal. This suggests a potential upward movement in the market.

- MACD Level (12, 26): The MACD Level at 41.80 provides a buy signal, indicating positive momentum.

- Stochastic RSI Fast (3, 3, 14, 14): The Stochastic RSI at 100.00 suggests a neutral stance. Extreme values may indicate potential reversals.

- Williams Percent Range (W%R 14): W%R stands at -1.29, signaling a neutral position. Values near -100 indicate potential oversold conditions.

- Bull Bear Power: At 169.52, Bull Bear Power indicates a neutral stance, reflecting the balance between bullish and bearish forces.

- Ultimate Oscillator (7, 14, 28): With a value of 73.54, the Ultimate Oscillator provides a buy signal, suggesting positive momentum.

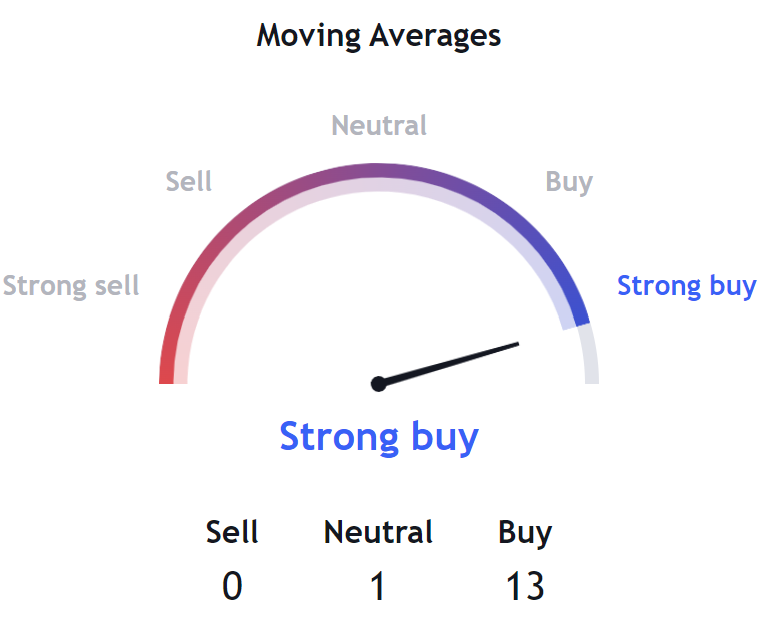

Moving Averages Analysis: Nasdaq Composite

Moving averages are essential for identifying trends and potential reversal points in a market. The Nasdaq Composite’s 1-hour time frame exhibits the following moving averages:

- Exponential Moving Average (10): EMA (10) stands at 15542.60, providing a buy signal.

- Simple Moving Average (10): SMA (10) at 15515.62 also signals a buy recommendation.

- Exponential Moving Average (20): EMA (20) at 15512.44 suggests a bullish trend.

- Simple Moving Average (20): SMA (20) at 15509.88 aligns with the bullish sentiment.

- Exponential Moving Average (30): EMA (30) at 15479.09 provides another buy signal.

- Simple Moving Average (30): SMA (30) at 15514.54 supports the overall bullish trend.

- Exponential Moving Average (50): EMA (50) at 15399.57 signals a continuation of the bullish trend.

- Simple Moving Average (50): SMA (50) at 15429.33 supports the overall positive sentiment.

- Exponential Moving Average (100): EMA (100) at 15234.41 indicates a sustained bullish trend.

- Simple Moving Average (100): SMA (100) at 15168.56 aligns with the overall positive market sentiment.

- Exponential Moving Average (200): EMA (200) at 14998.63 signifies a strong buy signal.

- Simple Moving Average (200): SMA (200) at 15022.88 supports the long-term bullish outlook.

- Ichimoku Base Line (9, 26, 52, 26): The Ichimoku Base Line stands at 15530.63, reflecting a neutral stance.

- Volume Weighted Moving Average (20): Information not available.

- Hull Moving Average (9): The Hull Moving Average at 15615.76 provides a buy recommendation, supporting the bullish trend.

Pivot Points Examination: Nasdaq Composite

Pivot points play a crucial role in identifying potential support and resistance levels. The Nasdaq Composite’s 1-hour time frame pivot points, classified into Classic, Fibonacci, Camarilla, Woodie, and DM, offer insights into potential reversal zones:

| Pivot | Classic | Fibonacci | Camarilla | Woodie | DM |

|---|---|---|---|---|---|

| S3 | 14881.80 | 15177.24 | 15374.12 | 15027.49 | – |

| S2 | 15177.24 | 15290.10 | 15401.20 | 15180.56 | – |

| S1 | 15316.30 | 15359.83 | 15428.28 | 15322.93 | 15394.50 |

| P | 15472.69 | 15472.69 | 15472.69 | 15476.00 | 15511.78 |

| R1 | 15611.75 | 15585.55 | 15482.45 | 15618.38 | 15689.94 |

| R2 | 15768.13 | 15655.27 | 15509.53 | 15771.45 | – |

| R3 | 16063.58 | 15768.13 | 15536.61 | 15913.82 | – |

Conclusion on Nasdaq Composite 1-hr Time Frame

In conclusion, the 1-hour time frame analysis of the Nasdaq Composite reveals a market that is currently exhibiting a mix of neutral and bullish signals. Oscillators, moving averages, and pivot points collectively suggest that the market is in a state of balance, with the potential for upward movement.

Traders and investors should carefully consider these technical indicators along with broader market trends, economic factors, and geopolitical events before making any investment decisions. The presented analysis provides a foundation for understanding the current market dynamics, but a comprehensive approach is necessary for the successful navigation of the ever-changing financial landscape.