Introduction: Unveiling the Dynamics of UPS Earnings and Analyst Predictions

Earnings reports are crucial for investors seeking insights into a company’s financial health. This article delves into United Parcel Service’s (UPS) recent fiscal performance, comparing analyst forecasts with actual earnings. Understanding the reasons behind variances can provide valuable insights into UPS’s operational dynamics and market conditions.

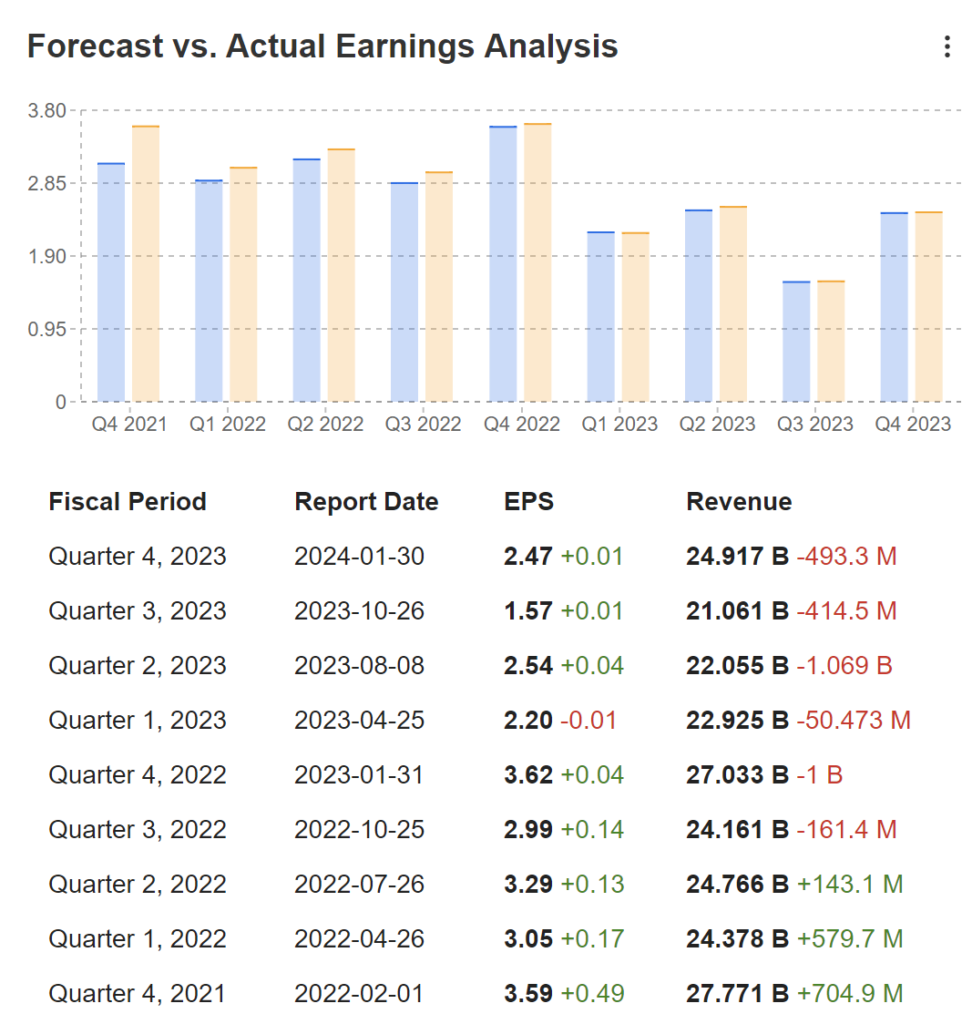

1. Analyst Forecasts vs. Actual Earnings: A Quarterly Snapshot

Analyzing United Parcel Services’s earnings performance over multiple quarters reveals fluctuations and trends that influence investor sentiments. The table below provides a comparative overview of analyst forecasts and actual earnings for the past few quarters:

Here is a Quarterly Snapshot of United Parcel Services EPS and Revenue with Latest Quarter 4 2023 Data which is reported on 30th Jan 2024.

| Fiscal Period | Report Date | EPS | Revenue |

|---|---|---|---|

| Quarter 4, 2023 | 2024-01-30 | 2.47 +0.01 | 24.917 B -493.3 M |

| Quarter 3, 2023 | 2023-10-26 | 1.57 +0.01 | 21.061 B -414.5 M |

| Quarter 2, 2023 | 2023-08-08 | 2.54 +0.04 | 22.055 B -1.069 B |

| Quarter 1, 2023 | 2023-04-25 | 2.20 -0.01 | 22.925 B -50.473 M |

| Quarter 4, 2022 | 2023-01-31 | 3.62 +0.04 | 27.033 B -1 B |

| Quarter 3, 2022 | 2022-10-25 | 2.99 +0.14 | 24.161 B -161.4 M |

| Quarter 2, 2022 | 2022-07-26 | 3.29 +0.13 | 24.766 B +143.1 M |

| Quarter 1, 2022 | 2022-04-26 | 3.05 +0.17 | 24.378 B +579.7 M |

| Quarter 4, 2021 | 2022-02-01 | 3.59 +0.49 | 27.771 B +704.9 M |

2. Analysis of Significant Variances

2.1 Q4 2023 (2024-01-30)

- EPS Actual: 2.47 (+0.01)

- Revenue Actual: 24.917 B

- Revenue Variance: -493.3 M

In the most recent quarter, analysts’ predictions were almost on target, with a negligible variation of +0.01 in EPS. However, the revenue fell short by 493.3 million, indicating potential challenges in meeting revenue expectations.

2.2 Q2 2023 (2023-08-08)

- EPS Actual: 2.54 (+0.04)

- Revenue Actual: 22.055 B

- Revenue Variance: -1.069 B

While EPS exceeded forecasts, the revenue witnessed a substantial negative variance of 1.069 billion. This points to potential operational challenges or unforeseen circumstances impacting UPS’s revenue generation.

2.3 Q1 2023 (2023-04-25)

- EPS Actual: 2.20 (-0.01)

- Revenue Actual: 22.925 B

- Revenue Variance: -50.473 M

A slight negative variance in EPS and a marginal revenue miss suggest a generally accurate forecast, but some factors may have affected the revenue stream negatively.

Read More: UPS Announces 12,000 Workforce Reduction and Strategic Review Amid Revenue Concerns

3. Trends and Patterns: Unraveling UPS’s Fiscal Performance

3.1 Positive Trends

- Q2 2022 (2022-07-26): EPS and Revenue exceeded expectations, showcasing UPS’s ability to outperform analyst predictions.

- Q1 2022 (2022-04-26): A substantial positive variance in both EPS and Revenue suggests robust performance during this period.

3.2 Challenging Quarters

- Q3 2023 (2023-10-26): While the EPS variance was minimal, a notable revenue miss indicates potential hurdles in meeting revenue targets.

- Q4 2021 (2022-02-01): A significant positive variance in EPS, but a slight revenue miss, indicating a potential focus on profitability over revenue growth.

4. Insights and Considerations for Investors

Understanding the nuances behind forecast variations is crucial for investors to make informed decisions. Several factors could contribute to these variances:

4.1 External Factors

- Global Economic Conditions: Economic fluctuations and global events can impact UPS’s performance.

- Pandemic-Related Challenges: Ongoing pandemic-related disruptions may have affected operational efficiency and revenue But It should not have caused a major disruption.

4.2 Internal Operational Dynamics

- Cost Management: UPS’s ability to manage costs influences profitability and, subsequently, EPS.

- Supply Chain Challenges: Disruptions in the supply chain could impact revenue, as seen in Q2 2023.

5. Looking Forward: Anticipating UPS’s Future Earnings Performance

Analysts and investors should closely monitor UPS’s strategic moves, macroeconomic conditions, and the company’s ability to adapt to evolving challenges. Q4 2023’s revenue miss raises questions, emphasizing the importance of continuous scrutiny and adjustment in investment strategies.

Conclusion: A Holistic View of UPS Earnings Performance

Analyzing United Parcel Service’s earnings performance provides valuable insights into its operational resilience and response to market dynamics. Investors navigating the stock market should consider a holistic approach, recognizing the interplay of internal and external factors shaping UPS’s financial trajectory. As UPS continues its journey, staying attuned to future forecasts and adapting strategies accordingly will be key for investors seeking sustainable returns in the dynamic world of stock investments.