Introduction

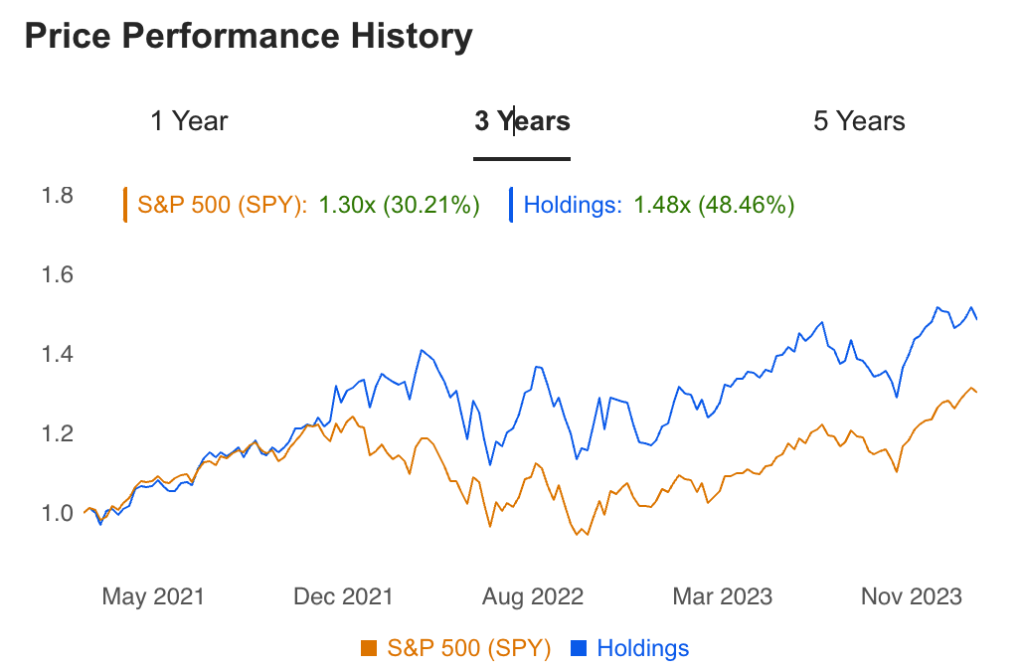

Warren Buffett, the Oracle of Omaha, is renowned for his unparalleled success in the world of investing. Recently disclosed SEC filings offer a glimpse into the core of Buffett’s portfolio, revealing a remarkable 48% return over the past three years.

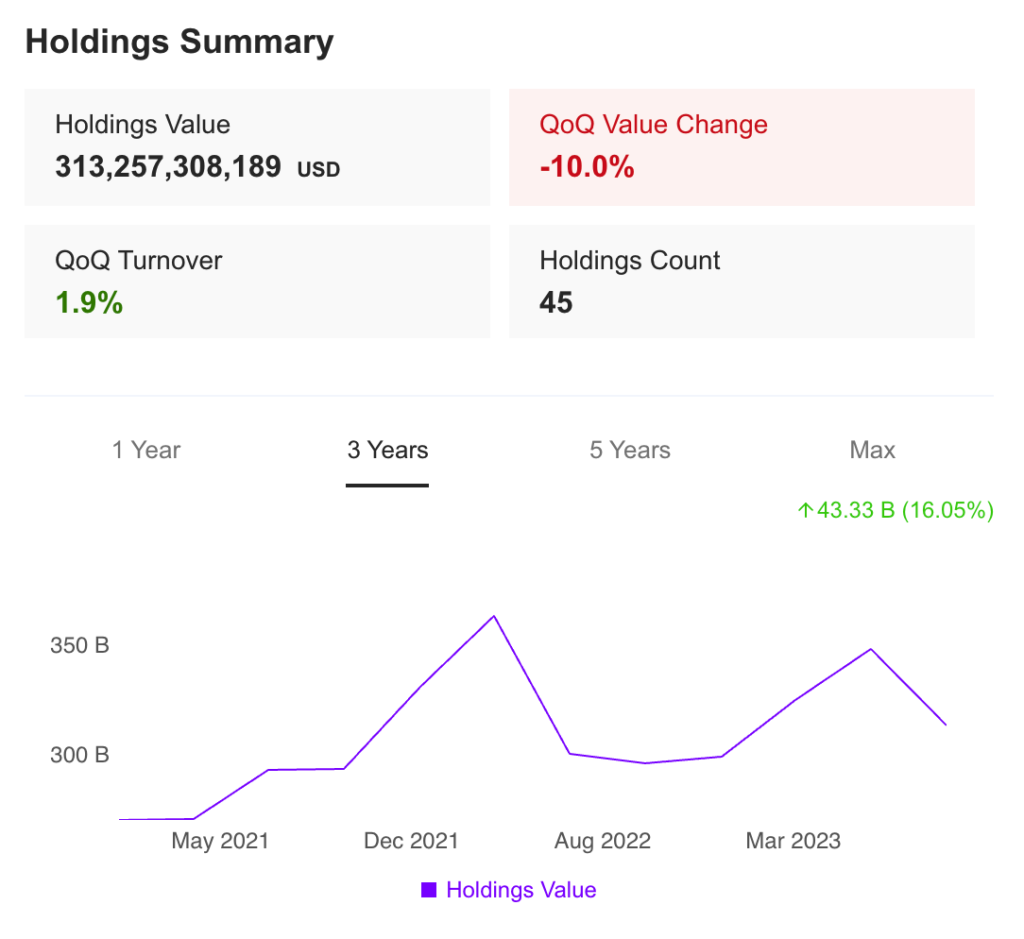

The Reporting Period was the quarter ending on Sep 30, 2023, and the SEC filing date was Nov 14, 2023.

In this comprehensive analysis, we’ll explore each holding, dissect the rationale behind his choices, and draw meaningful insights for investors seeking to understand the key to Buffett’s enduring success.

1. Apple Inc. (AAPL) – The Cornerstone of Buffett’s Wealth (50.0%)

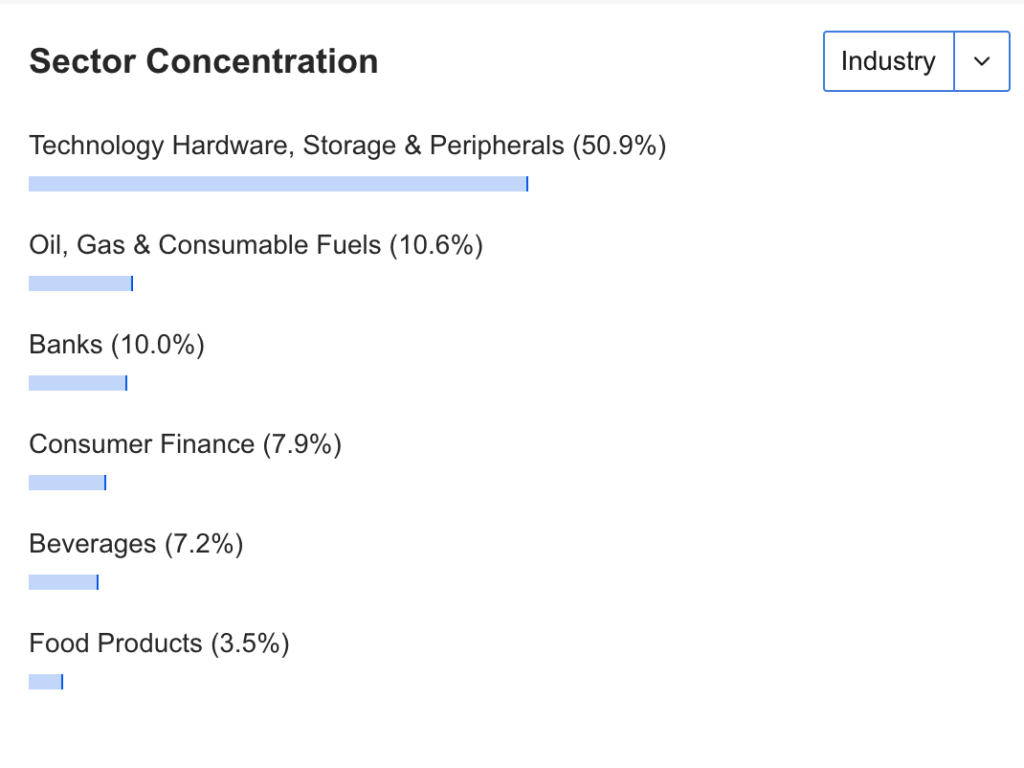

At the heart of Buffett’s portfolio lies Apple Inc., a tech giant that has become synonymous with innovation and market leadership. Accounting for a staggering 50% of the entire portfolio, Apple’s consistent performance and strategic positioning have not only fueled the company’s success but have also solidified its standing as a linchpin in Buffett’s investment strategy.

Buffett’s deep-rooted confidence in Apple is multifaceted. The company’s consistent revenue growth, robust balance sheet, and loyal customer base have created a compelling investment case. Moreover, Apple’s commitment to returning value to shareholders through dividends and share buybacks aligns seamlessly with Buffett’s preference for companies with a shareholder-friendly approach.

2. Financial Giants: Bank of America (BAC) and American Express (AXP) – Pillars of Stability (16% Combined)

Buffett’s strategic allocation to the financial sector is evident through Bank of America and American Express, representing 9.0% and 7.2% of the portfolio, respectively. These financial behemoths are not merely investments; they embody Buffett’s unwavering confidence in the resilience and long-term potential of the financial industry.

Bank of America’s strong market position and commitment to technological innovation align with Buffett’s preference for businesses with enduring competitive advantages. American Express, with its robust business model centered around affluent customers, reflects Buffett’s penchant for companies with a wide economic moat.

3. Coca-Cola (KO) – A Classic in the Portfolio (7.1%)

Coca-Cola, a staple in Buffett’s portfolio for decades, maintains its status as a cornerstone investment, constituting 7.1% of the total holdings. The enduring appeal of this classic brand is rooted in its global recognition, consistent cash flow, and resilience in the face of changing consumer preferences.

Buffett’s commitment to Coca-Cola exemplifies his belief in the enduring power of brands. The company’s strong dividend history and ability to weather economic storms further contribute to its allure as a long-term investment.

4. Energy and Consumer Staples: Chevron (CVX) and Kraft Heinz (KHC) – A Strategic Mix (13% Combined)

Diversification is a hallmark of Buffett’s investment strategy, evident in his holdings in the energy sector with Chevron and the consumer staples segment with Kraft Heinz, representing 5.9% and 3.5% of the portfolio, respectively.

Chevron’s inclusion underscores Buffett’s belief in the long-term energy demand, despite the evolving landscape towards renewable sources. Kraft Heinz, while facing challenges in recent years, reflects Buffett’s patience and conviction in allowing investments to recover over time.

Read More: I have opened a New savings account, Will It Impact My Credit Score in 2024?

5. New-Age Tech and Finance: Snowflake (SNOW) and Amazon (AMZN) – Navigating the Future (0.3% and 0.4%)

In a strategic move towards embracing the future, Buffett has dipped his toes into new-age technology with investments in Snowflake and Amazon, constituting 0.3% and 0.4% of the portfolio. While these positions represent a smaller percentage, they signify Buffett’s recognition of the evolving tech landscape.

Snowflake’s presence in the portfolio highlights Buffett’s openness to innovative, cloud-based technologies. Amazon, with its dominant position in e-commerce and cloud services, aligns with Buffett’s preference for companies with strong competitive advantages.

6. Takeaways and Investor Considerations

- Diversification Pays Off: Buffett’s portfolio reflects a well-balanced mix of sectors, showcasing the importance of diversification for long-term success.

- Stalwarts and Emerging Stars: The inclusion of both established giants like Coca-Cola and newer entrants like Snowflake demonstrates Buffett’s ability to adapt to changing market dynamics.

- Technology and Finance: A blend of traditional financial institutions and emerging tech companies suggests Buffett’s optimism about the future of finance and technology.

Warren Buffets Holding as Per Nov 14, 2023 Filing

The table mentions the Largest holdings as of the most recent Form 13F filing.

| Ticker | Name | Holding ($mil) | % of Portfolio |

|---|---|---|---|

| AAPL | Apple Inc. | 156,753.1 | 50.0% |

| BAC | Bank of America Corporation | 28,279.5 | 9.0% |

| AXP | American Express Company | 22,618.8 | 7.2% |

| KO | The Coca-Cola Company | 22,392.0 | 7.1% |

| CVX | Chevron Corporation | 18,590.1 | 5.9% |

| OXY | Occidental Petroleum Corporation | 14,541.5 | 4.6% |

| KHC | The Kraft Heinz Company | 10,954.4 | 3.5% |

| MCO | Moody’s Corporation | 7,799.8 | 2.5% |

| DVA | DaVita Inc. | 3,412.1 | 1.1% |

| HPQ | HP Inc. | 2,634.7 | 0.8% |

| VRSN | VeriSign, Inc. | 2,595.5 | 0.8% |

| C | Citigroup Inc. | 2,272.2 | 0.7% |

| KR | The Kroger Co. | 2,237.5 | 0.7% |

| V | Visa Inc. | 1,908.5 | 0.6% |

| CHTR | Charter Communications, Inc. | 1,684.0 | 0.5% |

| MA | Mastercard Incorporated | 1,578.4 | 0.5% |

| AON | Aon plc | 1,329.3 | 0.4% |

| AMZN | Amazon.com, Inc. | 1,271.2 | 0.4% |

| COF | Capital One Financial Corporation | 1,210.3 | 0.4% |

| PARA | Paramount Global | 1,209.1 | 0.4% |

| LSXM.K | The Liberty SiriusXM Group | 1,100.1 | 0.4% |

| SNOW | Snowflake Inc. | 935.8 | 0.3% |

| NU | Nu Holdings Ltd. | 776.6 | 0.2% |

| ALLY | Ally Financial Inc. | 773.7 | 0.2% |

| TMUS | T-Mobile US, Inc. | 734.1 | 0.2% |

Warren Buffet’s Berkshire Hathaway’s Inc All Stock Holdings with Exact Value($) and Shares

The below table tells you about Warren Buffet’s Berkshire Hathaway’s Inc Total Stock Holdings with Exact Value in dollars and total number of Shares as Per recent SEC filings.

| Name | Value ($) | Shares |

|---|---|---|

| Apple Inc | 156,753,093,002 | 915,560,382 |

| Bank Amer Corp | 28,279,487,924 | 1,032,852,006 |

| American Express Co | 22,618,800,333 | 151,610,700 |

| Coca Cola Co | 22,392,000,000 | 400,000,000 |

| Chevron Corp New | 18,590,066,491 | 110,248,289 |

| Occidental Pete Corp | 14,541,501,977 | 224,129,192 |

| Kraft Heinz Co | 10,954,355,278 | 325,634,818 |

| Moodys Corp | 7,799,843,711 | 24,669,778 |

| Davita Inc | 3,412,114,232 | 36,095,570 |

| Hp Inc | 2,634,739,200 | 102,519,035 |

| Verisign Inc | 2,595,546,101 | 12,815,613 |

| Citigroup Inc | 2,272,218,501 | 55,244,797 |

| Kroger Co | 2,237,500,000 | 50,000,000 |

| Visa Inc | 1,908,498,775 | 8,297,460 |

| Charter Communications Inc N | 1,684,044,831 | 3,828,941 |

| Mastercard Inc | 1,578,353,810 | 3,986,648 |

| Aon Plc | 1,329,302,000 | 4,100,000 |

| Amazon Com Inc | 1,271,200,000 | 10,000,000 |

| Capital One Finl Corp | 1,210,313,462 | 12,471,030 |

| Paramount Global | 1,209,129,578 | 93,730,975 |

| Liberty Media Corp Del | 1,100,083,089 | 4,320,829 |

| Snowflake Inc | 935,773,692 | 6,125,376 |

| Nu Hldgs Ltd | 776,611,184 | 107,118,784 |

| Ally Finl Inc | 773,720,000 | 29,000,000 |

| T-Mobile Us Inc | 734,142,100 | 5,242,000 |

| D R Horton Inc | 641,565,163 | 5,969,714 |

| Liberty Media Corp Del | 514,285,456 | 20,207,680 |

| Liberty Media Corp Del | 481,108,697 | 7,722,451 |

| Floor & Decor Hldgs Inc | 432,590,000 | 4,780,000 |

| Louisiana Pac Corp | 389,372,120 | 7,044,909 |

| Liberty Media Corp Del | 357,356,140 | 11,132,590 |

| Markel Corp | 233,706,251 | 158,715 |

| Liberty Media Corp Del | 161,257,223 | 5,051,918 |

| Stoneco Ltd | 114,120,430 | 10,695,448 |

| Globe Life Inc | 90,356,152 | 831,014 |

| Nvr Inc | 66,264,190 | 11,112 |

| Sirius Xm Holdings Inc | 43,768,172 | 9,683,224 |

| Diageo P L C | 33,975,745 | 227,750 |

| Liberty Latin America Ltd | 21,467,263 | 2,630,792 |

| Vanguard Index Fds | 16,886,100 | 43,000 |

| Spdr S&p 500 Etf Tr | 16,842,712 | 39,400 |

| Jefferies Finl Group Inc | 15,881,230 | 433,558 |

| Lennar Corp | 15,597,436 | 152,572 |

| Liberty Latin America Ltd | 10,477,603 | 1,284,020 |

| Atlanta Braves Hldgs Inc | 7,990,835 | 223,645 |

Conclusion on Warren Buffet’s 48% Portfolio Surge

Warren Buffett’s portfolio, as revealed in the recent SEC filings, provides a treasure trove of insights for investors. The 48% return over the past three years is not merely a testament to his investment prowess but also a masterclass in timeless investment principles. As investors navigate the complex world of financial markets, studying Buffett’s choices offers a valuable roadmap for long-term success. As always, thorough research and an understanding of personal risk tolerance are paramount when making investment decisions in today’s dynamic market environment.