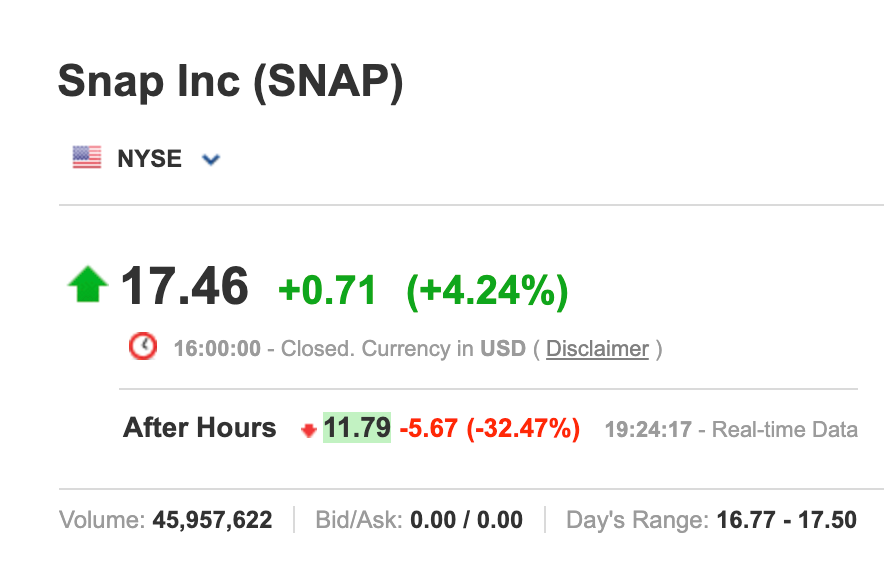

Introduction: Snap Inc. Loses More than 32% in After-Hours Trade on Tuesday

Snap Inc., the parent company of Snapchat, witnessed a staggering 32% decline in its shares during after-hours trading on Tuesday. This steep downturn followed the company’s Q4 earnings report, which fell short of revenue expectations, and its bleak forecast of a wider-than-expected EBITDA loss for the upcoming quarter Q1 2024. In this article, we deep dive into the details of Snap’s disappointing Q4 results and the concerning projections for Q1 2024.

Q4 Performance Analysis Snap Inc.

In Q4, Snap reported adjusted earnings per share (EPS) of 8 cents, a decline from 14 cents in the same period last year and below analysts’ expectations of 6.4 cents. While revenue increased by 4.7% year-over-year to $1.36 billion, it fell short of consensus estimates, which stood at $1.38 billion.

Snap Inc. Regional Revenue Breakdown

Snap’s revenue in the North America region reached $899.5 million, marking a 2.2% year-over-year increase and surpassing projections of $875.9 million. However, despite this regional growth, Snap’s overall revenue failed to meet expectations.

Adjusted EBITDA and User Metrics of Snap Inc.

Adjusted EBITDA for the quarter was reported at $159.1 million, reflecting a significant 32% decline from the previous year but surpassing analysts’ forecasts of $111.8 million. Snap reported 414 million daily active users (DAUs), a 10% increase from the year-ago period, slightly exceeding consensus estimates. However, average revenue per user (ARPU) experienced a 5.2% year-over-year decrease to $3.29, missing expectations of $3.33.

Free Cash Flow and Guidance for Q1 of Snap Inc.

Snap’s free cash flow for the quarter rose by an impressive 41% year-over-year to $110.9 million, exceeding analysts’ projections of $82 million. Looking ahead to Q1, Snap expects revenue to range between $1.10 billion and $1.14 billion, slightly below the consensus projection of $1.11 billion. However, the company’s projected adjusted EBITDA loss of $55 million to $95 million significantly surpasses analysts’ estimates of $32.7 million.

User Growth Expectations and External Factors

Snap Inc. anticipates reaching 420 million DAUs in Q1, exceeding the forecasted 418.55 million. However, the company acknowledges external challenges, citing the onset of the conflict in the Middle East as a headwind that impacted year-over-year growth by approximately 2 percentage points in Q4.

Conclusion on Q4 2023 Performance of Snap Inc.

The sharp decline in Snap’s stock price reflects investor concerns over the company’s ability to meet revenue expectations and control expenses amidst challenging market conditions. As Snap navigates through the uncertainties ahead, investors will closely monitor its execution of strategic initiatives, user growth metrics, and ability to adapt to evolving market dynamics. Despite the setbacks, Snap remains determined to drive innovation and sustainable growth, aiming to regain investor confidence in the long term.